1. How to Protect Assets from Creditors before a Lawsuit Is Filed

Strategic Planning for High-Risk Individuals

Successful asset protection planning is critical for those with significant professional liability or business exposure.

This includes:

- Medical Professionals: Surgeons and specialists facing high malpractice risk.

- Real Estate Investors: Owners of rental property portfolios vulnerable to tenant lawsuits.

- Business Owners: Closely-held company leaders protecting personal wealth from corporate defaults.

- High-Net-Worth Families: Individuals seeking to insulate generational wealth from civil judgments.

Asset Protection Vs. Tax Evasion

It is vital to distinguish between legal asset protection and illegal tax evasion. Asset protection is about who owns the title to an asset and how a creditor can reach it: it does not exempt you from federal or state income taxes. At SJKP LLP, we ensure that every structure, from LLCs to Irrevocable Trusts, is fully compliant with IRS reporting requirements while maintaining maximum barriers against civil judgments.

2. Internal and External Liability: Creating Silos for Risk Mitigation

Insulating Personal Assets from Business Risks (External Liability)

External liability occurs when a business entity is sued for an event related to its operations, such as a slip-and-fall at a rental property or a contract dispute. We utilize the "corporate shield" to ensure that the judgment is restricted to the assets held within that specific entity. By properly titling assets into separate LLCs, we prevent a creditor from reaching your personal residence, savings accounts, or other unrelated business interests.

Protecting Business Assets from Personal Claims (Internal Liability)

Internal liability arises when you are sued personally, perhaps due to a car accident or a personal guarantee on a loan. In this scenario, a creditor will attempt to seize your ownership interests in your businesses to satisfy the debt. We utilize charging order protections and restricted membership agreements to ensure that while a creditor may have a right to future distributions, they cannot seize control of the company or force the liquidation of business assets.

3. When Is It Too Late for Asset Protection Planning?

Timing and the Voidable Transaction Rule

Courts look for "badges of fraud," such as transferring assets to a family member for zero consideration immediately after being served with a summons. If a transfer is deemed voidable, the court can reverse the transfer and potentially impose punitive damages. Therefore, the strategic placement of assets into protective structures must occur while the financial sea is calm.

4. Legal Entities and the Corporate Shield

Charging Order Protection in Llcs

The Limited Liability Company (LLC) is one of the most powerful tools for asset protection from creditors due to the "Charging Order" remedy. In many jurisdictions, if a member of an LLC is sued personally, the creditor’s only remedy against the LLC interest is a charging order. This means the creditor only has a right to distributions from the LLC, but they cannot step into the member's shoes, manage the company, or force a liquidation of the assets inside the LLC.

The Mathematics of Liability Insulation

The effectiveness of an asset protection structure can be viewed as a ratio of the cost of litigation to the probability of recovery. If an asset is held in a multi-member LLC with restricted distribution rights, the settlement value for a creditor drops significantly.

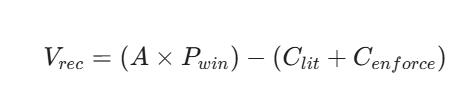

We represent the Net Recoverable Value ($V_{rec}$) for a creditor as:

- $A$: The total value of the asset.

- $P_{win}$: The probability of the creditor successfully "piercing" the entity.

- $C_{lit}$: The cost of litigation.

- $C_{enforce}$: The cost of overcoming statutory protections like charging orders.

By increasing $C_{enforce}$ and decreasing $P_{win}$ through clinical legal drafting, we make the pursuit of your assets an irrational financial move for most creditors.

5. Statutory Exemptions: Protecting Home and Retirement

Homestead Exemptions and Titled Property

The Homestead Exemption protects a portion, or in some states, the entirety, of the equity in your primary residence from general creditors. However, this protection varies wildly by state. In states like Florida or Texas, the protection is nearly absolute, whereas other states provide only a nominal exemption. We help clients navigate these variances, ensuring that equity is maximized within the most protective jurisdictional boundaries.

Erisa and Retirement Account Protection

Assets held in qualified retirement plans, such as 401(k)s and certain pensions, are protected by the Employee Retirement Income Security Act (ERISA). Federal law generally prohibits creditors from seizing these funds to satisfy civil judgments. However, IRAs (Individual Retirement Accounts) are governed by state law and may have lower levels of protection. We provide a forensic audit of your retirement portfolio to ensure that your long-term savings are held in the most creditor-proof accounts possible.

6. Irrevocable Trusts and Jurisdictional Leverage

Domestic Asset Protection Trusts (Dapts)

Several states, such as Nevada, South Dakota, and Delaware, have enacted statutes allowing for "Self-Settled Spendthrift Trusts." These Domestic Asset Protection Trusts (DAPTs) allow you to be a beneficiary of your own trust while protecting the assets from your future creditors. By utilizing a spendthrift clause, the trust prevents a creditor from compelling the trustee to make a distribution to pay a debt.

Offshore Asset Protection and Jurisdictional Leverage

In complex cases, moving assets to offshore jurisdictions like the Cook Islands or Nevis provides the ultimate shield. These jurisdictions do not recognize foreign judgments. A creditor would be forced to re-litigate the entire case in a foreign court, often under a "beyond a reasonable doubt" standard of proof for fraudulent transfers. This creates a nearly insurmountable barrier for even the most aggressive institutional creditors.

7. Why Sjkp Llp Is the Authority in Wealth Defense

21 Jan, 2026