1. Debt Consolidation Is a Strategic Reorganization, Not Debt Forgiveness

The primary tactical error made by consumers is the belief that debt consolidation reduces the principal amount owed to creditors.

In reality, consolidation is the process of transferring debt from multiple sources into a single, centralized vehicle.

Unlike debt settlement or bankruptcy, consolidation does not involve the "forgiveness" of any portion of the principal. You are simply taking out Loan B to pay off Loans A, C, and D. While this may simplify your administrative burden, the success of the strategy depends entirely on the terms of the new contract. If the interest rate on the new loan is not significantly lower than the weighted average of the previous debts, the consolidation serves no financial purpose. It is a reorganization of liability, not a reduction of it.

2. The Mathematics of Debt Consolidation: the Cost of Time

The effectiveness of debt consolidation is determined by a clinical calculation of the total cost of debt over the lifetime of the new loan, rather than the immediate reduction in monthly payments.

Lenders often market consolidation loans based on a lower "monthly payment," but this is frequently achieved by extending the repayment term, which can result in a higher total interest payout.

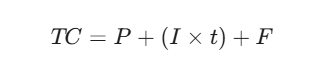

To determine the true cost of a consolidation strategy, we utilize the following formula:

Where:

- TC: Total Cost of the loan.

- P: Principal amount (the sum of all debts being consolidated).

- I: The annual interest rate of the new loan.

- t: The time period of the loan in years.

- F: All associated fees, including origination fees, balance transfer fees, and closing costs.

By extending a three-year credit card debt into a seven-year personal loan, the total interest paid often exceeds the original terms. A forensic debt audit is required to ensure the "Monthly Payment Illusion" does not lead to a greater long-term financial burden.

3. Forensic Evaluation of Consolidation Vehicles

Each consolidation method carries unique legal and financial risks that must be analyzed before committing to a new credit agreement.

Personal Loan Debt Consolidation

Personal loans are typically unsecured and based on credit scores. While they provide a fixed rate, they often come with high origination fees 1% to 8%. If a borrower defaults, the lender can move immediately to litigation and wage garnishment, as the debt has been "refreshed" into a new, single contract.

Balance Transfer Credit Cards and the 0% Apr Trap

0% Introductory APR offers are effective if the balance is paid within the promotional period (12–21 months). However, any remaining balance often triggers a Penalty APR exceeding $25\%$. Furthermore, transfer fees of 3% to 5% represent a significant upfront cost F added to your principal.

Home Equity and Heloc Consolidation: the Risk of Collateralization

The most dangerous strategy involves using a Home Equity Loan or HELOC to pay off unsecured debt. This process converts unsecured debt, which is easily dischargeable in bankruptcy, into secured debt that puts your home at risk. While homestead exemptions generally protect your home from credit card collectors, a HELOC allows the lender to initiate foreclosure proceedings directly upon default. This is a catastrophic trade of legal safety for a marginally lower interest rate.

4. Strategic Criteria: When Consolidation Makes Sense

Debt consolidation is a viable strategy only when a borrower meets specific clinical criteria that ensure the long-term sustainability of the new loan.

Criteria | Ideal Status | Risk Factor |

|---|---|---|

Credit Score | Above 700 | Low scores lead to interest rates that offer no savings. |

Delinquency Status | Current or < 30 days late | Deeply delinquent debt is better suited for settlement or bankruptcy. |

Interest Rate Differential | At least 5% lower than current | Small differences are offset by loan origination fees. |

Spending Habit Control | High | Consolidating debt without closing old cards often leads to "Double Debt." |

If you do not meet these criteria, a consolidation loan is likely to fail, leading to a "Second Wave" of debt that is even more difficult to manage.

5. Clinical Failure Points: When Consolidation Becomes a Liability

In the realm of debt litigation, there are specific points where a consolidation attempt is no longer a solution and instead becomes a legal liability.

- Deep Delinquency: If you are already 90 days or more delinquent, you likely will not qualify for a favorable rate. Attempting to consolidate at this stage often results in high-interest subprime loans that accelerate insolvency.

- Pending Litigation: If a creditor has already filed a lawsuit, a consolidation loan will not stop the judicial process. Legal intervention through a defense attorney or a bankruptcy stay is the only way to halt litigation.

- Zombie Debt Risks: If your debt has been bought by a third-party debt buyer, consolidating it may "revive" a debt that was otherwise unenforceable due to missing documentation or an expired statute of limitations. You should never consolidate debt that has been sold without first conducting a standing audit.

6. Comparison: Debt Consolidation Vs. Debt Relief Vs. Bankruptcy

Feature | Debt Consolidation | Debt Relief (Settlement) | Bankruptcy (Statutory) |

|---|---|---|---|

Principal Reduction | No (0%) | Partial (40% to 60%) | Full (100% in many cases) |

Legal Protection | None | Limited | Immediate (Automatic Stay) |

Credit Impact | Low (Short term) | High (Long term) | High (Short term recovery) |

Litigation Risk | Low (if paid) | High (during negotiation) | Eliminated |

Consolidation is a reorganization strategy for early-stage debt, whereas settlement and bankruptcy are defensive litigation tools for when repayment is no longer mathematically possible.

7. Hidden Legal Risks in Consolidation Contracts

Consolidation loan agreements often contain aggressive clauses designed to maximize the lender's recovery in the event of a default.

Cross-Default Clauses

Many credit unions include "Cross-Default" clauses. These state that a default on the consolidation loan constitutes a default on every other loan you have with that institution. Defaulting on a personal loan could allow the bank to repossess your vehicle, even if your car payments are current.

Acceleration Provisions

A consolidation loan is a single, large liability. A single missed payment can trigger an "Acceleration Clause," allowing the lender to demand the entire balance immediately. Unlike juggling four smaller cards, a default on a consolidated loan results in one massive lawsuit leading to immediate bank levies or wage garnishments.

The Statute of Limitations Reset

Take out a consolidation loan "resets the clock" on the statute of limitations. If your debt was nearing the point of being legally unenforceable due to age, creating a new consolidation contract gives the creditor a fresh period of several years to sue you for the balance.

8. Faq: Common Legal Questions Regarding Consolidation

Can debt consolidation stop an active lawsuit?

No. Debt consolidation is a voluntary financial agreement, not a court order. If you have been served with a summons, only a formal legal defense or a bankruptcy filing can halt the litigation process.

Does consolidating debt affect bankruptcy eligibility?

It can. Taking out a large consolidation loan shortly before filing for bankruptcy can be scrutinized as "presumptive fraud" or bad faith. It is essential to consult a debt consolidation attorney before making large structural changes to your debt profile.

Is debt consolidation better than debt settlement?

Consolidation is better for those who can afford full repayment at a lower interest rate and wish to protect their credit. Settlement is a defensive strategy for those who cannot pay the principal and are willing to trade credit scores for debt reduction.

9. Why Sjkp Llp Handles Debt Evaluation Differently

Success in debt management requires a partner who understands the dual nature of consolidation as both a financial tool and a legal contract.

At SJKP LLP, we do not provide loans: we provide senior-level legal advocacy. Before recommending any consolidation path, we perform a "Forensic Debt Audit" to determine if the numbers support a recovery or if they merely delay an inevitable legal crisis.

We evaluate your portfolio for standing defects, expired statutes of limitations, and predatory contract clauses. We recognize that for our clients, the goal is not just a simpler payment, but a final and irrevocable end to the debt cycle. We don't negotiate from a position of debt: we litigate from a position of legal right.

21 Jan, 2026