1. The Legal Mechanics of an IRS Tax Levy

Understanding the statutory progression of a levy is essential for identifying the precise moment legal intervention can be used to stop the seizure.

The IRS does not seize assets without warning: it follows a rigid sequence of notices that, if ignored, lead to the "Final Notice of Intent to Levy."

The Statutory Notice Sequence

Before a levy can occur, the IRS must satisfy three legal requirements:

- Assessment and Demand: The IRS must assess the tax and send a "Notice and Demand for Payment."

- Neglect or Refusal to Pay: The taxpayer must have failed to pay the amount demanded.

- Final Notice of Intent to Levy: The IRS must send a "Final Notice of Intent to Levy and Notice of Your Right to a Hearing" at least 30 days before the seizure begins.

The Critical Distinction between a Lien and a Levy

It is a common tactical error to confuse a tax lien with a tax levy. A lien is a placeholder that secures the government’s interest in your property, whereas a levy is the execution that physically takes the property. While a lien attaches to all property you own, a levy is a specific action against a specific asset, such as a bank account or a weekly paycheck.

2. Common Targets of IRS Seizures and Specific Defense Windows

The IRS utilizes automated data-matching systems to identify and seize liquid assets that provide the highest probability of immediate recovery.

At SJKP LLP, we move with speed to shield these specific assets before the levy is finalized.

Bank Account Levies and the 21-Day Holding Period

When the IRS serves a levy on your bank, the bank is required to freeze the funds immediately. However, federal law provides a 21-day holding period before the bank must send the money to the IRS. This 21-day window is the most critical period for legal defense. If an experienced attorney intervenes during this time, we can often secure a "Release of Levy" by proving economic hardship or procedural errors, preventing the funds from ever leaving the bank. Once the 21-day holding period expires, even federal court intervention may not recover the seized funds.

Continuous Wage Garnishments and Income Protection

Unlike a bank levy, which is a one-time event, a wage levy is "continuous." It attaches to your future earnings and remains in effect until the tax debt is fully paid or the levy is released. The IRS is permitted to seize a significant portion of your take-home pay, leaving only a small exempt amount based on the number of dependents you claim. We litigate to modify or release these garnishments by demonstrating that the levy prevents you from meeting basic living expenses.

3. Collection Due Process (Cdp) and Statutory Defenses

A Collection Due Process (CDP) hearing is the primary legal mechanism used to challenge a levy and force the IRS to consider less intrusive collection alternatives.

Filing a request for a CDP hearing within the 30-day window following the Final Notice triggers a stay of the levy, effectively "freezing" the IRS's ability to seize assets while the case is reviewed.

Hardship and the Economic Reality Defense

Under Section 6343 of the Internal Revenue Code, the IRS must release a levy if it determines that the levy is causing an "immediate economic hardship." We provide the IRS with a clinical financial analysis proving that the seizure of funds would render the taxpayer unable to pay for housing, utilities, or medical care. Proving hardship is the most effective way to secure a total release of a levy and move the account into "Currently Not Collectible" (CNC) status.

Challenges to the Underlying Liability

In certain circumstances, a CDP hearing allows the taxpayer to challenge the actual amount of the tax owed. This is possible if the taxpayer did not receive a "Statutory Notice of Deficiency" or did not otherwise have an earlier opportunity to contest the liability. By litigating the validity of the tax assessment itself, we can often reduce or eliminate the debt that triggered the levy action. Missing the CDP deadline permanently eliminates your right to Tax Court review.

4. Strategic Alternatives to Asset Seizure and Permanent Resolution

Avoiding an IRS tax levy requires more than just stopping the seizure: it requires a permanent resolution of the underlying debt through court-approved settlement programs.

Offer in Compromise (Oic) and Settlement Calculations

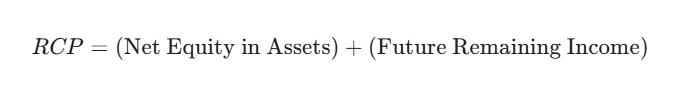

An Offer in Compromise allows a taxpayer to settle their tax debt for less than the full amount owed. The IRS accepts an OIC if the "Reasonable Collection Potential" (RCP) of the taxpayer is less than the total liability. We utilize forensic accounting to maximize allowable expenses and minimize the valuation of assets, forcing the IRS to accept a fraction of the original debt.

The Reasonable Collection Potential is calculated as:

Installment Agreements and Partial Payment Plans

If a total settlement is not feasible, we negotiate an Installment Agreement that fits your budget. A "Partial Payment Installment Agreement" (PPIA) allows you to pay back only a portion of what you owe over the remaining life of the statute of limitations. Once the agreement is signed, the IRS is legally required to release any active levies.

5. Why Timing and Procedural Accuracy Determine the Outcome

In IRS enforcement cases, the law provides powerful protections, but they are strictly contingent on meeting the 30-day statutory deadlines.

- Before the Final Notice: Maximum flexibility to negotiate a voluntary resolution.

- During the 30-Day CDP Window: The only time to secure an "Automatic Stay" and preserve your right to go to U.S. Tax Court.

- During the 21-Day Bank Hold: The final opportunity to stop the bank from transmitting your funds to the IRS.

- After the Funds are Transmitted: Recovery of seized funds is nearly impossible, shifting the battle to prevent future seizures.

Timing is not strategic here. It is dispositive.

6. Why Sjkp Llp Is the Authority in Tax Levy Defense

SJKP LLP provides the aggressive, clinical advocacy necessary to halt IRS enforcement and restore your financial stability.

We do not view a tax levy as an administrative problem: we view it as a challenge to your rights that must be met with superior legal strategy. We move with speed to file for CDP hearings, audit IRS records for notice failures, and weaponize federal statutes to ensure your assets are protected.

An IRS tax levy is not the end of the road. It is the moment where legal strategy matters most. Most taxpayers contact a lawyer only after their bank account has already been emptied. At that point, the law has already taken many powerful options off the table. If you are facing the threat of an IRS seizure, you do not need a tax resolution firm: you need an IRS tax levy attorney who treats the enforcement process as a litigation event.

21 Jan, 2026