1. The Five Pillars of an Effective Sanctions Compliance Program (SCP)

OFAC evaluates the adequacy of a compliance program through the framework of five essential pillars, which serve as the definitive benchmark for regulatory leniency during enforcement actions.

A robust SCP must be tailored to the organization’s specific risk profile, accounting for its products, services, customers, and geographic footprint.

Management Commitment and Cultural Accountability

The first pillar is management commitment, which requires senior leadership to provide adequate resources, authority, and autonomy to the compliance unit. This includes the designation of a dedicated Sanctions Compliance Officer and the promotion of a "culture of compliance" throughout the organization. OFAC specifically looks for evidence that compliance staff have direct reporting lines to the board.

Routine Risk Assessment and External Touchpoints

An effective SCP must conduct routine, top to bottom risk assessments to identify potential vulnerabilities in its global supply chain. This involves evaluating customers, counterparties, and intermediaries to identify "high risk" regions or industries. SJKP LLP assists in developing risk assessment methodologies that are updated dynamically as sanctions regimes evolve.

Internal Controls and Interdiction Protocols

Internal controls are the specific policies and procedures designed to identify, interdict, escalate, and report prohibited transactions. These controls must capture the day to day operations of the business and include clear escalation chains for "hits" identified during the screening process.

2. Sanctions Screening and Fuzzy Logic Implementation

Sanctions screening is a mandatory operational safeguard that requires the clinical comparison of all counterparties against the Specially Designated Nationals (SDN) and Blocked Persons List.

Modern screening protocols must go beyond exact name matching to account for aliases, misspellings, and deliberate evasion tactics.

- Fuzzy Logic and Phonetic Matching:

Utilizing advanced software to identify partial matches and phonetic similarities that might otherwise bypass a literal search.

- Batch Screening vs. Real-Time Integration:

Ensuring that both current databases and new transactions are screened continuously against updated OFAC lists.

- False Positive Remediation:

Establishing a professional protocol for investigating and clearing false hits to prevent unnecessary operational disruption while maintaining absolute regulatory integrity.

3. The 50 Percent Rule and Beneficial Ownership Scrutiny

The OFAC 50 Percent Rule represents a significant jurisdictional trap, as any entity owned 50 percent or more by one or more blocked persons is itself considered blocked, even if it does not appear on any sanctions list.

This requires a "look-through" approach to beneficial ownership that extends beyond the immediate counterparty to the ultimate controlling individuals.

Aggregation of Ownership Interests

Under this rule, if Person A (blocked) owns 25% and Person B (blocked) owns 25% of an entity, that entity is blocked. The complexity of modern corporate vehicles often obscures these ownership chains, necessitating forensic due diligence to identify the practical and economic realities of control.

Indirect Dealings and Opaque Structures

Predatory actors frequently utilize shell companies and layered investment structures to shield the involvement of sanctioned persons. We provide the clinical oversight needed to perform "enhanced due diligence" (EDD) on complex ownership chains, ensuring that the enterprise does not inadvertently facilitate a prohibited transaction.

4. Enforcement Actions and Strict Liability Exposure

OFAC operates under a strict liability standard, meaning that a company can be held liable for a sanctions violation even if it had no knowledge or reason to know it was engaging in a prohibited transaction.

Enforcement actions are categorized as "egregious" or "non-egregious," with the latter often resulting from systemic failures in the compliance program.

Civil and Criminal Monetary Penalties

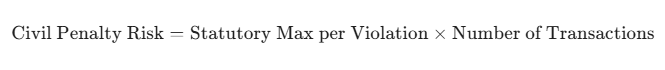

The statutory maximum for civil penalties is adjusted periodically for inflation and is often calculated per violation. For egregious cases, the base penalty can be the statutory maximum or the full value of the underlying transaction.

The Impact of Administrative Subpoenas

When OFAC suspects a violation, it issues administrative subpoenas and "Requests for Information" (RFIs). These are high pressure proceedings that require a technically perfect response. SJKP LLP manages these responses with clinical precision, focusing on root cause analysis to demonstrate the organization’s commitment to remediation.

5. Voluntary Self-Disclosure (VSD) and Mitigation Strategies

Voluntary Self-Disclosure (VSD) is the most powerful tool available to an organization for mitigating the severity of OFAC penalties.

If an organization identifies an apparent violation, reporting it to OFAC before the agency initiates its own investigation can result in a 50 percent reduction of the base penalty amount.

The "Self-Correction" Benefit

Beyond financial mitigation, a VSD can lead to a "Non-Prosecution Agreement" (NPA) or a "Deferred Prosecution Agreement" (DPA) if the organization demonstrates immediate and effective remedial action. This includes updating internal controls and providing additional training to personnel.

Weighing the Disclosure Decision

The decision to disclose is a high stakes strategic move. We provide the clinical risk analysis needed to evaluate the "egregiousness" of the conduct and the likelihood of agency discovery, ensuring that the disclosure is managed as a professional safeguard for the enterprise’s reputation.

6. Why SJKP LLP stands as the Authority in OFAC Matters

Selecting SJKP LLP to manage an OFAC Compliance matter ensures that your organization is protected by a firm that treats sanctions risk as a high stakes jurisdictional priority. We recognize that in the current global environment, a single sanctions violation can be a terminal event for a business. Our firm provides a firm legal safeguard, integrating judicial advocacy with a deep understanding of the forensic environment surrounding sanctions screening and beneficial ownership analysis.

We do not simply offer general advice; we build proactive strategies that identify root causes of violations, evaluate the strength of your internal controls, and assess the validity of your VSD strategies with clinical precision. Our senior partners take a hands-on approach to every engagement, ensuring that you have the most experienced minds at the table during every high stakes negotiation with Treasury Department regulators. At SJKP LLP, we believe that the legal system should provide a clear and fair path for enterprises to maintain their financial sovereignty while complying with national security mandates.

19 Jan, 2026