1. What Is a Property Division Agreement?

Definition and Legal Purpose

A property division agreement divorce filing is used to avoid the uncertainty of a court-ordered distribution. It provides the parties with the authority to decide how to partition real estate, retirement accounts, and business interests. This document can be executed during a divorce, as part of a legal separation, or even as a postnuptial arrangement. Once it is signed and acknowledged by the court, it carries the same weight as a judicial decree.

When Property Division Agreements Are Used

These agreements are the cornerstone of uncontested divorces and successful mediations. By resolving property issues outside of a trial, the parties can utilize creative solutions: such as asset offsets: that a judge might not have the discretion to order. SJKP LLP also utilizes these agreements in post-judgment modifications when new financial realities necessitate a reorganization of the original decree.

2. Marital Property Vs Separate Property

Identifying Marital Assets

Marital property generally includes everything acquired by either spouse during the marriage. This encompasses:

- Real Estate: The marital home, vacation properties, and investment holdings.

- Retirement Accounts: 401(k) plans, IRAs, and defined benefit pensions.

- Business Interests: Professional practices, closely held corporations, and equity.

- Investment Portfolios: Brokerage accounts, cryptocurrency, and stock options.

Separate Property and Commingling Risks

Separate property (assets owned before the marriage or received via inheritance) is generally not subject to division. However, separate assets often become "commingled" over years of marriage. If separate funds were used to pay a marital mortgage, the asset may lose its separate status. We apply a forensic "tracing" methodology to identify separate property interests and protect them from being included in the marital pot.

3. Legal Requirements for an Enforceable Property Division Agreement

Voluntary Execution and Full Disclosure

For an agreement to be valid, both parties must sign it voluntarily. Any evidence of duress or coercion can be grounds for the court to set the agreement aside. More importantly, there must be "full and fair" financial disclosure. If one spouse hides an offshore account or a business interest, the entire property division agreement is at risk of being invalidated for fraud.

Fairness and Court Review Standards

While parties have broad discretion, the court will review the agreement for "unconscionability." If the distribution is so one-sided that it shocks the conscience of the court, a judge may refuse to approve it. SJKP LLP ensures that your agreement meets the judicial scrutiny requirements of your specific state while maximizing your financial position.

4. Common Clauses in a Property Division Agreement

Asset Allocation Provisions

The agreement must specify exactly how assets will be transferred. For retirement accounts, this includes the requirement for a Qualified Domestic Relations Order (QDRO). For real estate, it must define the timeline for a buyout or a sale, including who is responsible for maintenance costs during the listing period.

Debt Responsibility and Indemnification

Joint debts are just as critical as joint assets. We utilize "hold harmless" and indemnification clauses to ensure that if one spouse fails to pay a credit card or mortgage they were assigned, the other spouse is protected from legal and credit consequences.

Tax Allocation and Capital Gains Considerations

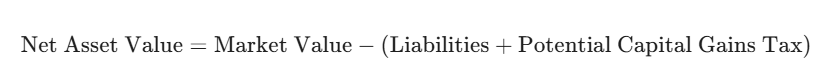

High-net-worth distributions often trigger significant tax events. We conduct a clinical analysis of capital gains, especially regarding the sale of a marital home or the liquidation of stocks.

SJKP LLP ensures that the "equitable" split is calculated based on net value after taxes, not gross value.

5. Court Approval and Enforcement

Incorporation into Divorce Judgment

To ensure maximum protection, we move to have the property division agreement "incorporated" into the final Judgment of Divorce. Depending on your state, this can be done through "merger" or "incorporation by reference." This step allows the court to enforce the property terms using its contempt powers.

Enforcement Remedies

If a spouse refuses to transfer an asset as agreed, we utilize several enforcement tools:

- Contempt of Court: Seeking fines or incarceration for non-compliance.

- Judgment Liens: Placing a legal claim on the breaching spouse's other property.

- Garnishments: Redirecting income to satisfy the property debt.

6. Risks of Poorly Drafted Property Division Agreements

Ambiguity and Litigation Exposure

Vague language regarding the "future sale" of an asset or "reasonable efforts" to pay a debt is a catalyst for post-divorce litigation. If the agreement is not surgically precise, you may spend more on attorney fees to interpret the document than you saved on the initial drafting.

Hidden Assets and Future Claims

Without a robust "Non-Disclosure" clause, a spouse who discovers hidden assets years later may have a difficult time reopening the case. We include specific protective language that provides for severe penalties if a party is found to have omitted assets from the initial disclosure.

7. Why Sjkp Llp Is the Authority in Financial Reorganization

26 Jan, 2026