1. What Is Spousal Support Enforcement?

2. Definition of Alimony Enforcement

When Enforcement Becomes Necessary

Litigation is triggered under several conditions:

- Total Non-Payment: The payer has ceased all transfers.

- Partial Payments: The payer is "shorting" the monthly amount.

- Chronic Delinquency: Payments are consistently late, causing financial instability for the recipient. State laws regarding the definition of "delinquency" vary, but most courts allow for enforcement actions once a single payment is missed or partially unpaid.

3. Legal Authority Behind Spousal Support Enforcement

Court Orders and Mandatory Compliance

Compliance with a support order is not optional. Once a judge signs the decree, the payment schedule is legally binding. If payments are missed, they become "arrears." In the eyes of the law, arrears are a vested debt. SJKP LLP ensures that every missed payment is documented and converted into a judgment that can be executed against the payer’s assets.

Vested Payments and Non-Modifiability

A critical concept in spousal support enforcement is the "anti-retroactive" rule. In almost every state, a court cannot retroactively reduce or eliminate alimony payments that have already become due. Even if the payer lost their job six months ago, they are still liable for the full amount of support until they file a formal motion to modify. Until that motion is filed, the debt is fixed and enforceable.

4. Common Enforcement Tools Used by Courts

Wage Garnishment and Income Withholding

This is the most direct method of spousal support enforcement. An Income Withholding Order (IWO) is sent directly to the payer’s employer. The employer is legally required to deduct the alimony amount from the payer’s paycheck before they ever see the money. This removes the payer's ability to "prioritize" other bills over their support obligations.

Contempt of Court Proceedings

If a payer has the ability to pay but refuses to do so, they are in "contempt."

Civil Contempt: Designed to force compliance. The payer can be jailed until they pay a "purge" amount (usually the total of the arrears).

- Criminal Contempt: Designed to punish the violation of a court order. This can result in fixed jail time and criminal fines. State standards for "willful" non-payment differ, but the threat of incarceration is often the most effective catalyst for recovery.

5. Enforcing Support against Self-Employed or High-Income Spouses

Bank Levies and Asset Seizure

For self-employed payers, we utilize bank levies. This allows the sheriff or a court officer to freeze and seize funds directly from the payer’s bank accounts, investment portfolios, or business operating accounts. This is particularly effective in spousal support enforcement against high-net-worth individuals who may not have a traditional "paycheck" but possess significant liquidity.

Liens on Property and Retirement Accounts

If a payer owns real estate, we can place a judgment lien on the property. This prevents them from selling or refinancing the home without first paying off the support arrears. In some cases, we can also utilize a Qualified Domestic Relations Order (QDRO) to tap into the payer’s retirement accounts to satisfy a judgment for unpaid support.

6. Defenses Raised by the Paying Spouse and How Courts Respond

Inability to Pay Claims

The most common defense is a claimed change in circumstances, such as job loss or medical emergency. However, the burden of proof is on the payer. They must prove that their inability to pay is "involuntary." If the payer is simply choosing to pay other creditors first, the court will not accept this as a valid defense in a spousal support enforcement action.

Bad Faith and Imputed Income

If a payer intentionally reduces their income or quits a job to avoid alimony, the court may "impute" income.

This means the court will calculate support based on what the payer could earn based on their education and experience, not what they claim to earn. We utilize vocational experts and forensic accountants to prove that the payer’s financial situation is a result of bad faith.

7. Interest, Penalties, and Attorney’S Fees

Accrued Interest on Arrears

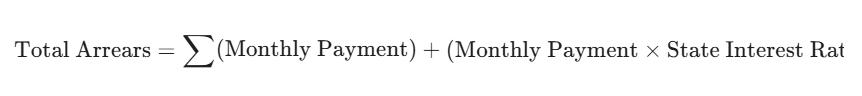

Unpaid support accumulates interest at a rate set by state law. In many jurisdictions, this interest is mandatory and cannot be waived by the judge. We use the following logic to calculate the total debt:

This ensures that the value of your support award is protected against inflation and delay.

Recovery of Legal Costs

Most states allow the recipient to recover their attorney's fees and court costs in a successful spousal support enforcement case. SJKP LLP aggressively pursues these fees, ensuring that the payer is responsible for the litigation costs caused by their own non-compliance.

8. Why Early Enforcement Action Matters

Preventing Asset Dissipation

The longer you wait to begin spousal support enforcement, the more time the payer has to hide assets, transfer property to third parties, or move funds offshore. By acting quickly, we can secure temporary restraining orders that freeze the payer's assets before they can be dissipated.

Strategic Timing and Leverage

Early action establishes that you will not tolerate non-compliance. This creates significant leverage in future negotiations. A payer who knows that a missed payment will immediately result in a bank levy or a contempt hearing is much more likely to prioritize their support obligations.

9. Why Sjkp Llp Is the Authority in Support Collection

26 Jan, 2026