1. What Constitutes Corporate Control and Domination under New York Law?

Corporate control and domination refer to the exercise of substantial influence over an entity's strategic direction and budget allocations by a specific individual or group. This concentrated authority often bypasses traditional board oversight, which can create vulnerabilities in essential systems like data security or financial reporting.

The Concept of Idiosyncratic Vision

Executive dominance often stems from an idiosyncratic vision where a founder or CEO maintains absolute control over the firm's long term trajectory. While this leadership style can drive rapid growth, it frequently results in the marginalization of independent compliance officers and risk management protocols. Under New York standards, the court evaluates whether this vision obscured the standard of care required to protect the interests of the public and shareholders. Properly identifying the limits of executive discretion is the first step in constructing a resilient governance defense.

Legal Personhood and Accountability

The legal personhood of a corporation is intended to provide a shield, but this protection does not extend to directors who utilize domination to authorize illegal acts or ignore warning signs. Practitioners examine whether the controlling party treated the organization as an alter ego to further personal interests at the expense of corporate integrity. Documenting the lack of internal checks and balances is a mandatory requirement for proving that a board failed in its oversight duties. Establishing this factual baseline allows for the subsequent application of corporate governance standards during litigation.

2. How Do New York Courts Provide Legal Redress for Corporate Control and Domination?

Legal redress for issues arising from corporate control and domination typically involves filing derivative lawsuits or collective actions in the New York Supreme Court. The primary issue for plaintiffs is demonstrating that the controlling party's decisions directly caused material harm through negligence or a breach of fiduciary duty.

Derivative Actions and Standing

A shareholder may initiate a derivative suit to hold dominant directors accountable if a pre suit demand on the board is deemed futile. The court looks for evidence that the directors are not independent or are under the absolute domination of a single executive, which prevents them from acting in the best interest of the entity. Successful litigation can result in mandatory structural reforms, the removal of negligent officers, and the recovery of dissipated corporate funds. Seeking professional assistance regarding corporate litigation is essential for navigating these procedural hurdles successfully.

Statutory Remedies and Damages

New York Business Corporation Law provides specific mechanisms for rectifying the abuse of power, including judicial dissolution or the appointment of a receiver in cases of gross mismanagement. Aggrieved parties may seek compensatory damages for financial losses and permanent injunctions to stop ongoing deceptive trade practices. The following table summarizes the primary legal claims often asserted in these complex market disputes:

| Claim Category | Legal Objective and Impact |

|---|---|

| Breach of Loyalty | To punish self dealing or the misappropriation of opportunities. |

| Gross Negligence | To address the failure to monitor critical infrastructure and security. |

| Unjust Enrichment | To recover profits gained through the neglect of mandatory safeguards. |

| Fraudulent Inducement | To rectify misleading statements made to secure investor capital. |

3. What Legal Impacts of Corporate Control and Domination Were Seen in the Coupang Case?

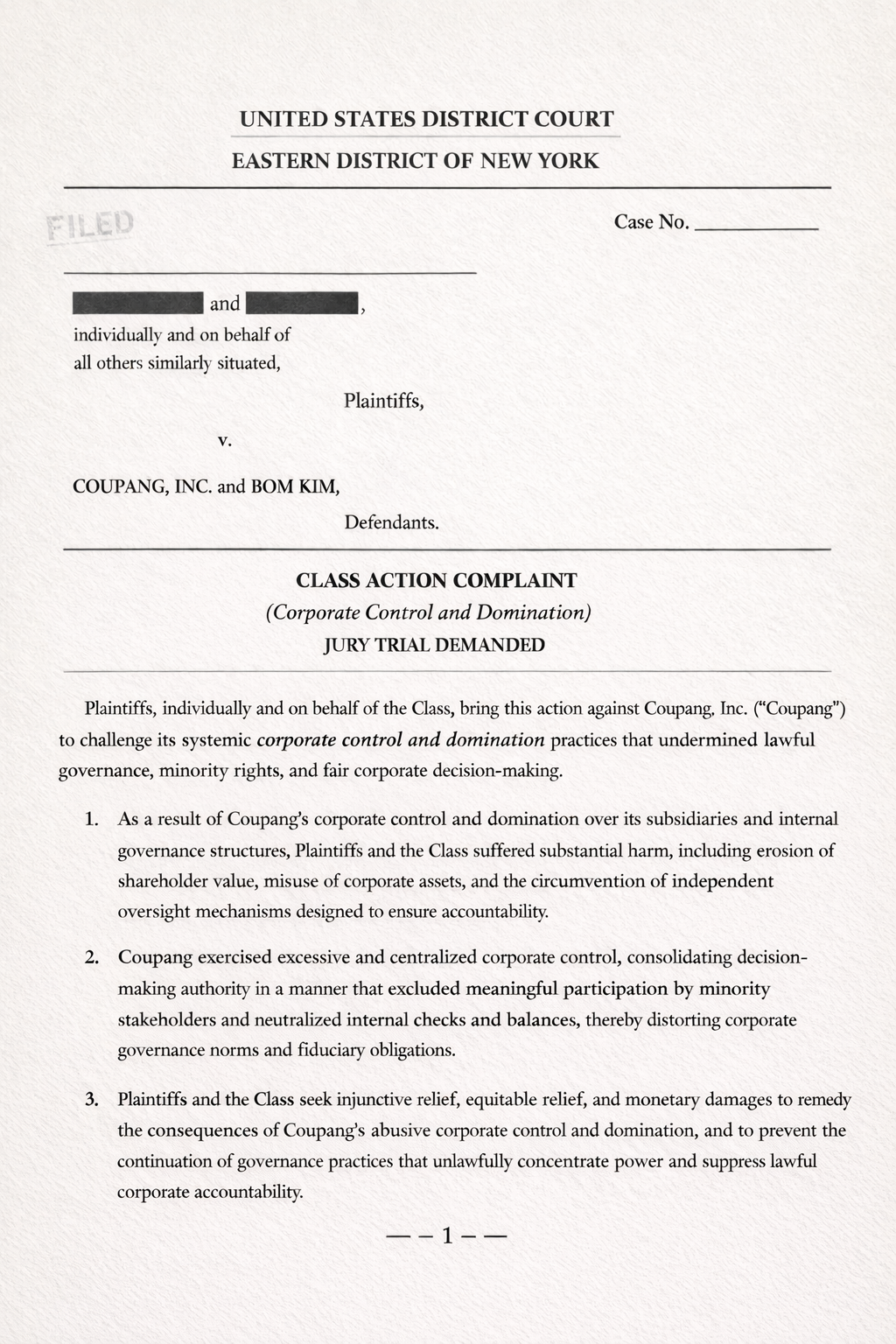

The 2025 Coupang data leak litigation provides a critical case study on how executive dominance can lead to massive unauthorized exposure and subsequent legal liability. In this matter, the lead plaintiff asserts that the CEO, Bom Kim, exercised actual control over the budget and data security policies.

Analysis of Management Neglect

The lawsuit alleges that the failure to allocate adequate resources for data protection was a direct result of the CEO's personal decision making hierarchy. By prioritizing short term operational targets over essential security infrastructure, the leadership allegedly facilitated a catastrophic breach that impacted millions of residents. The court must now evaluate whether this pattern of neglect constitutes a violation of the SHIELD Act and federal consumer protection standards. This scenario highlights why individual directors can be held personally liable when their domination results in systemic harm to the public.

The Role of Subclasses in Recovery

In high profile cases involving multinational entities, the legal team often establishes specific subclasses to address diverse geographic impacts, such as a subclass for residents in South Korea. This strategic alignment ensures that all victims, regardless of their location, receive fair representation and access to settlement funds. The Coupang case serves as an important precedent for how class action litigation can be used to challenge the unchecked power of a dominant executive. Effective management of these subclasses is the hallmark of a professional and resilient approach to collective justice.

4. Why Is an Attorney Necessary for Cases Involving Corporate Control and Domination?

A professional legal team acts as the primary investigator of corporate compliance, bridging the gap between complex forensic data and judicial requirements. Specialized advisors help in identifying internal audits that reveal when the board first became aware of potential vulnerabilities.

Strategic Advocacy and Discovery

Attorneys manage the aggressive discovery process required to uncover hidden internal communications and budget logs that prove a lack of oversight. They coordinate with technical experts to verify whether industry standard encryption and intrusion detection systems were intentionally neglected. By asserting rights in the New York Commercial Division, counsel ensures that the corporate veil is not used to shield intentional or reckless misconduct. This level of scrutiny provides the necessary leverage for a comprehensive resolution that includes both monetary relief and permanent reforms.

Risk Mitigation and Compliance

Beyond litigation, legal counsel assists organizations in implementing robust internal controls to prevent future instances of corporate control and domination. This includes the appointment of truly independent directors and the establishment of secure whistleblower channels to identify anomalies early. By prioritizing ethical leadership and legal transparency, firms can foster trust with the court and maintain their standing in a competitive global economy. Seek early consultation with a specialized attorney to ensure your business or personal interests are prepared for the next generation of legal challenges. Professional monitoring of these standards is part of our commitment to excellence at all times.

10 Feb, 2026