1. Corporate Governance Litigation New York : Strategic Triggers

The issue involves identifying when internal management choices deviate from the standard of care required by law, and the court must evaluate whether the board acted in good faith. Under the New York Business Corporation Law, a pattern of neglect often serves as the primary catalyst for judicial intervention. In conclusion, establishing a clear link between executive decisions and material loss is mandatory before filing a formal complaint.

Institutional Neglect and Policy Failure

Directors must act with the diligence, the care, and the skill of an ordinarily prudent person in a similar position. When a board fails to oversee critical systems, such as data security, financial reporting, or environmental compliance, it exposes the entity to significant regulatory risks. Shareholders may initiate a claim if they identify a lack of internal controls, the unauthorized dissipation of corporate funds, or the reckless disregard of warning signs. Detailed evidential records of internal audits, budget approvals, and meeting minutes serve as the primary proof during the early phase of an investigation. Furthermore, sudden shifts in the organization, which often include distressed mergers or selective buybacks, provide the necessary grounds for judicial review. Legal practitioners must evaluate whether the leadership prioritized short term profits over the long term ethical health of the firm. Proper legal positioning ensures the organization is prepared for the resulting judicial scrutiny.

2. Corporate Governance Litigation New York : Derivative Standing

The issue for many plaintiffs is the absolute preservation of standing while navigating the procedural hurdles of a shareholder claim, and they must demonstrate that the suit benefits the entity itself. Under state mandates, a successful strategy requires a precise demonstration that a pre suit demand on the board would have been futile due to director interest. Ultimately, professional advocacy ensures the legal narrative remains focused on specific breaches of loyalty.

Demand Futility and Representative Roles

To initiate a suit on behalf of the corporation, a shareholder must prove that the directors are not independent, or they must show that the board is interested in the challenged transaction. This unique procedural rule prevents meritless litigation while allowing legitimate claims of misconduct to proceed to the discovery phase. The following list outlines the primary roles within a standard New York derivative framework:

- Nominal Defendant: The corporation on whose behalf the legal action is being brought by the group.

- Lead Plaintiff: The individual who represents the class, and they direct the overall legal strategy.

- Independent Director: A board member with no financial ties, no familial links, and no interest in the act.

- Equitable Decree: A court order intended to rectify failures, which may include removing a director.

Maintaining transparency between these roles is vital for the legitimacy of the judicial process. By establishing clear boundaries, the legal team can mitigate the risks of internal conflict during prolonged proceedings. Detailed data management of communication logs is the first line of defense against defense motions to dismiss the action. Consistent adherence to these protocols facilitates a smoother path toward a final judgment.

3. Corporate Governance Litigation New York : Executive Liability

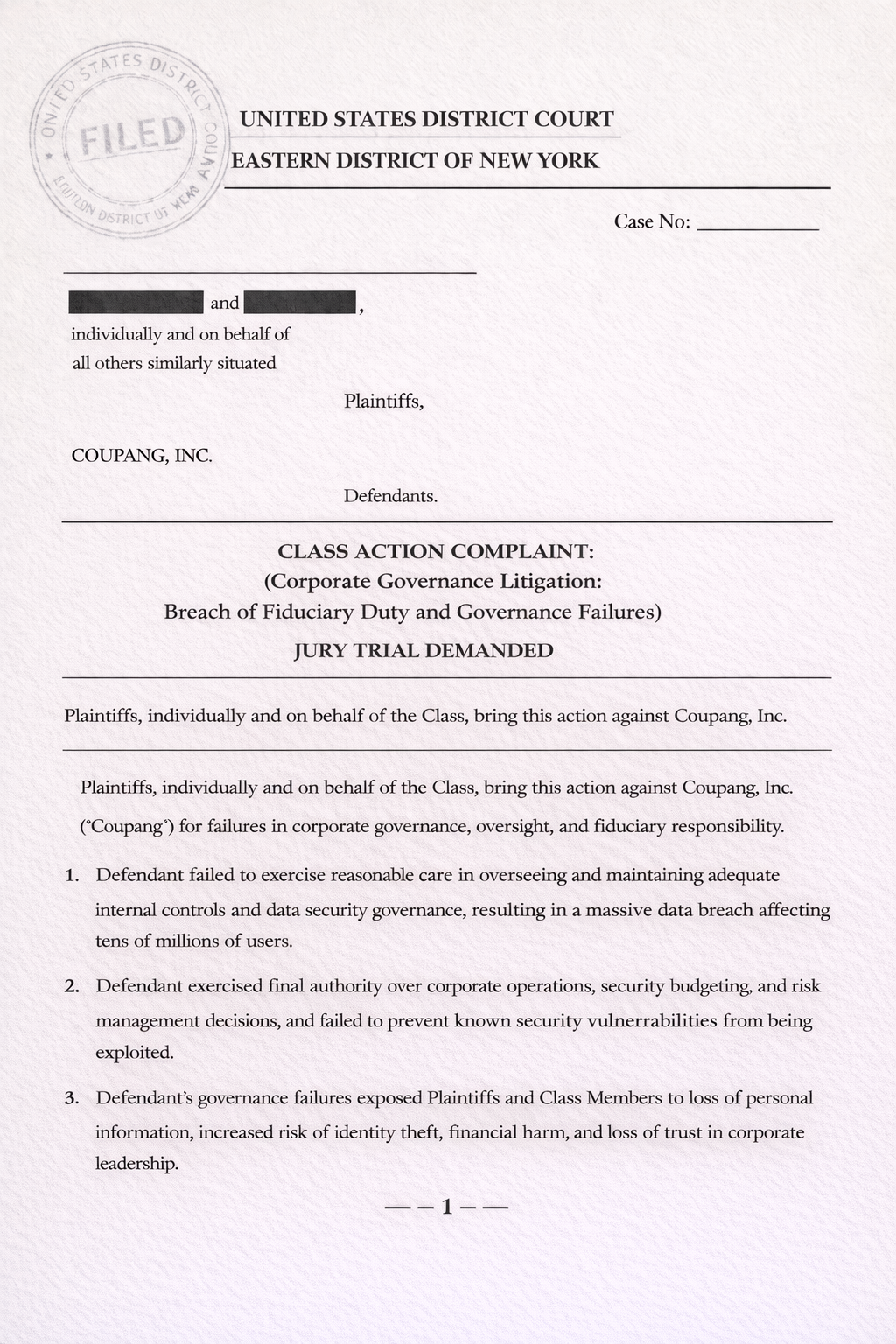

A recurring issue in recent litigation involves the assertion of personal liability against high level executives who exercised actual control, and judges frequently examine the level of individual involvement. The attached complaint image illustrates how multiple counts of negligence and unjust enrichment can be asserted against both the entity and its leadership. In conclusion, judicial outcomes now emphasize that the corporate veil will not protect directors who authorize or ignore illegal acts.

Causes of Action and Accountability

In cases involving massive data exposure or accounting irregularities, courts examine whether the CEO fulfilled their oversight duties. The following table summarizes the common legal theories often cited in a New York corporate governance complaint:

| Cause of Action | Legal Description and Objective |

|---|---|

| Negligence | Failure to uphold the duty of care, or the neglect of assets. |

| Waste of Assets | The irrational distribution of capital to insiders or associates. |

| Unjust Enrichment | Profiting from revenue that should have been spent on safeguards. |

| Statutory Violations | Violation of specific codes, which include the FTC or SHIELD Acts. |

Applying these diverse theories ensures that the defendant is held accountable under all applicable state and federal mandates. The focus remains on demonstrating a causal link between the management failure and the resulting economic distress. Meticulous adherence to these evidentiary standards provides the necessary leverage for a comprehensive settlement that includes both monetary relief and systemic change. Proper legal positioning is the hallmark of a resilient approach to corporate accountability in a competitive market.

4. Corporate Governance Litigation New York : Strategic Resolutions

The final phase involves navigating the intense discovery and the procedural nuances of the New York Commercial Division, and practitioners must manage vast volumes of information. The issue for many litigants is the volume of digital evidence, and they often require forensic experts to verify claims of mismanagement. In conclusion, the integration of legal integrity and technical mastery is the only way to secure a permanent resolution.

Fiduciary Prudence and Professional Advocacy

Choosing a firm with experience in corporate litigation is a mandatory prerequisite for any group seeking to challenge a large organization. These advisors assist in conducting deep due diligence to uncover hidden emails, and they identify internal audits that reveal when the board first identified the vulnerability. They also coordinate with specialized counsel in corporate governance to implement required structural reforms. By prioritizing ethical leadership and legal transparency, practitioners can foster trust with the court and achieve a more predictable outcome. Seeking early consultation ensures that your personal and business interests are prepared for the next generation of legal challenges. Ultimately, the successful management of your case depends on the integrity, the skill, and the litigation capital of the chosen firm. Proactive management of these standards is part of our commitment to excellence at all times.

10 Feb, 2026